Cost Segregation for Developers: Unlocking Cash Flow on 2026 Infrastructure

![[HERO] Cost Segregation for Developers: Unlocking Cash Flow on 2026 Infrastructure](https://cdn.marblism.com/oHv4caCkKEb.webp)

If you're developing land in North Texas right now, you're probably feeling the cash flow squeeze. Between site prep costs, utility connections, and road improvements: not to mention the actual vertical construction: your capital is tied up for months or even years before you see a return. But here's something most developers either don't know about or aren't fully utilizing: cost segregation studies can pull a massive chunk of your depreciation forward, putting real cash back in your pocket when you need it most.

I'm Dan Cooper with Cooper Land Company, and after years of working development projects across Collin, Denton, Dallas, and Tarrant Counties, I've seen firsthand how the right tax strategy can make or break a project's cash position. Let's talk about how cost segregation works specifically for infrastructure spending: and why 2026 might be the best year yet to take advantage of it.

What Cost Segregation Actually Does

Here's the traditional problem: when you develop a commercial property, the IRS says you depreciate that building over 39 years. Residential? 27.5 years. That's a long time to wait for your tax deductions, especially when you've got debt service, carrying costs, and the next project calling your name.

Cost segregation flips that script. Instead of lumping everything into one long depreciation schedule, a proper cost segregation study breaks your project down into components and reclassifies them into shorter depreciation periods: 5, 7, or 15 years instead of nearly four decades.

You're getting the same total deduction over time, but you're accelerating when you get it. That timing difference is everything when you're managing development cash flow.

The Infrastructure Sweet Spot

For land developers in North Texas, the real magic happens with site improvements and infrastructure: the stuff you're spending serious money on before a single tenant moves in.

Roads and paving are prime candidates. That half-mile of private street you just put in to access your mixed-use development? Instead of depreciating it over 39 years, it likely qualifies for 15-year treatment. Parking lots, sidewalks, and curbing often fall into the same category.

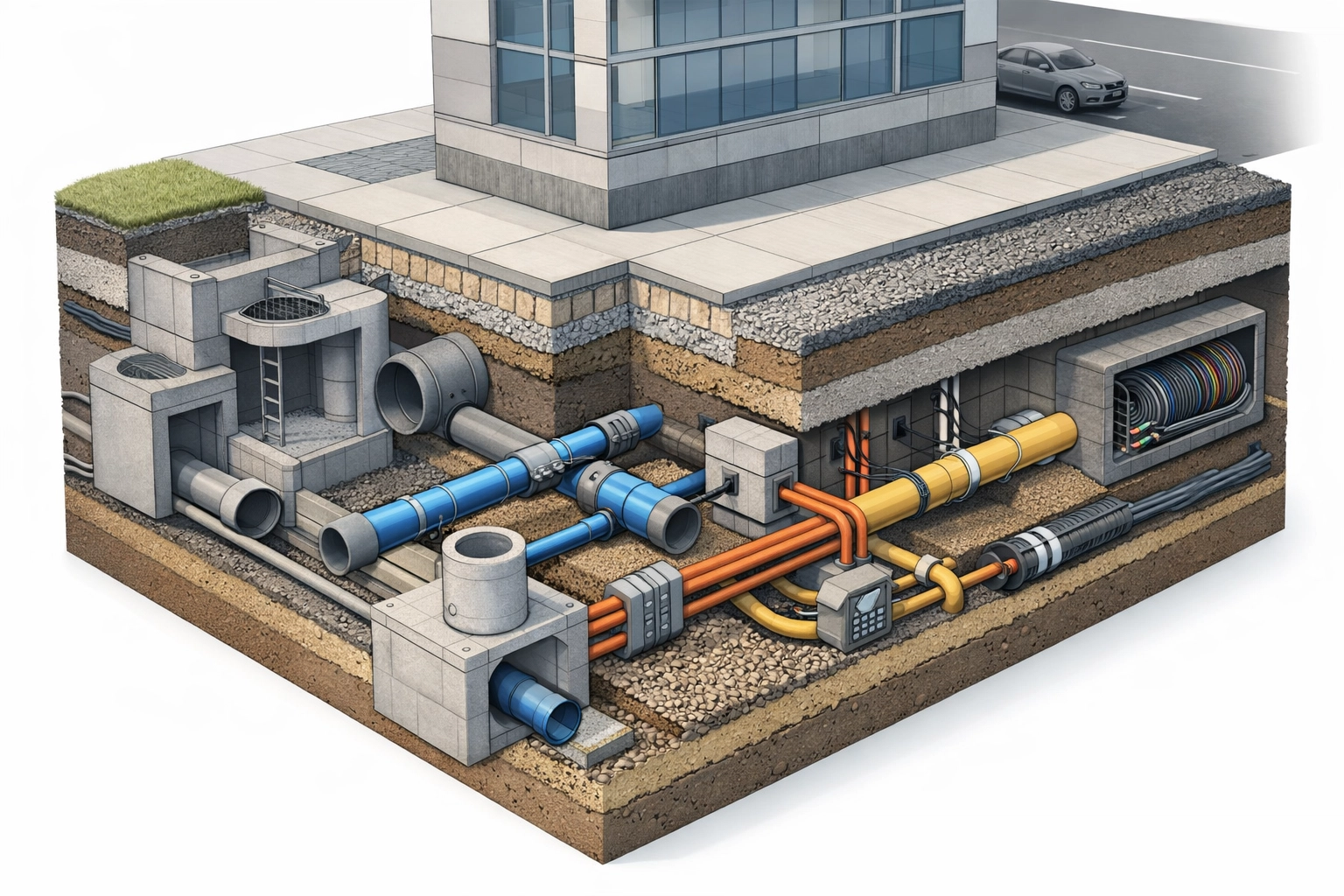

Utility infrastructure is another big one. Water lines, sewer laterals, electrical distribution systems, gas lines: these aren't part of the building structure. A good cost segregation study will pull them out and depreciate them on an accelerated schedule. When you're running utilities to a 50-acre tract in Prosper or Celina, that's not a trivial expense.

Site preparation costs can also qualify. Grading, excavation, retention ponds, and drainage systems are often reclassified. If you're developing in Denton County and dealing with difficult topography, those earthwork costs add up fast: and you can depreciate them much sooner than you think.

Land improvements like fencing, gates, signage, and landscaping elements (not the land itself, obviously) can also be accelerated. Even the specialty lighting you installed in your retail development's parking lot might qualify for 5- or 7-year treatment.

The 2026 Advantage: 100% Bonus Depreciation Is Back

Here's where things get really interesting for developers right now. As of January 19, 2025, 100% bonus depreciation has been permanently restored for qualified property placed in service. That means you can write off the entire accelerated portion of your project in year one if you choose to.

Let's make this concrete. Say you're developing a 100,000-square-foot industrial building in southern Denton County. Total project cost is $15 million. Without cost segregation, you're depreciating the entire structure over 39 years: roughly $385,000 per year.

Now run a cost segregation study. Let's say the engineer identifies $4 million in components that qualify for accelerated depreciation: your site utilities, access roads, parking lot, specialized electrical systems, whatever. With 100% bonus depreciation, you can deduct that entire $4 million in year one.

That's not a $4 million savings: it's the tax on $4 million, which at a 35% effective rate (combining federal and state) is around $1.4 million in cash you keep instead of sending to the government. For a developer carrying $15 million in debt at 7%, that $1.4 million covers nearly a year's worth of interest. That's breathing room.

Real Numbers from the Field

The research backs this up. One $18 million multifamily project ran a $10,000 cost segregation study and reduced their tax bill by $1.7 million. That's a 170-to-1 return on the study cost. Another developer identified $650,000 in accelerated assets per location, freeing up $40,000 annually per property in tax liability. They used that cash flow to open additional locations: turning tax strategy into expansion capital.

I've seen similar results right here in North Texas. One of our clients developed a mixed-use tract in McKinney: retail on the ground floor, multifamily above. The infrastructure alone (roads, utilities, parking structure, site lighting) was over $3 million. By accelerating that depreciation in year one, they offset nearly all the taxable income from their other holdings and preserved capital for the next phase.

When Does Cost Segregation Make Sense?

Not every project needs a cost segregation study, but most do if you're dealing with significant infrastructure spend. Here's my rule of thumb:

Minimum project size: Studies typically cost between $7,500 and $10,000 for straightforward projects (complex ones requiring reverse engineering can run $20,000-$30,000). The math usually works when you're looking at $1 million or more in real estate investment: and that's an easy threshold to hit when you're developing raw land into finished sites in Collin or Denton County.

Current taxable income: You need taxable income to offset. If you're in a loss position already, accelerating depreciation doesn't help you right now (though you can carry losses forward). This works best for developers with profitable projects or other income streams.

Hold period: If you're flipping the property in 12 months, cost segregation might not pencil out. But if you're holding it for lease-up, stabilization, or long-term income, you absolutely want to run the numbers.

Multiple properties: If you've got a portfolio, you can stagger studies across years to strategically offset taxable income. One year you accelerate depreciation on your Allen project, the next year your Frisco project, and so on.

Designing for Depreciation

Here's a pro move: run your cost segregation analysis before you break ground, not after. If you know which components qualify for accelerated depreciation, you can design your buildout to maximize those costs. Maybe you spec out better parking lot materials or upgrade your utility infrastructure: investments that improve the property and carry better tax treatment.

Your engineer and CPA can work together to model different scenarios and match depreciation deductions with cash outlays. It's strategic planning, not just reactive accounting.

The North Texas Landscape

Cost segregation is particularly valuable in our market right now. North Texas development isn't slowing down: we're still seeing massive projects along the Dallas North Tollway corridor, the 380 corridor through Prosper and McKinney, and the build-out west of I-35 in Denton County. But with interest rates where they are and construction costs still elevated, every developer I talk to is laser-focused on cash flow preservation.

Infrastructure spending is through the roof because we're building on raw land, not infill sites. Running utilities a mile to connect your project isn't unusual anymore. Those costs: often 15% to 25% of total project basis: are sitting there waiting to be accelerated.

How Cooper Land Company Can Help

At Cooper Land Company, we've been part of enough development projects to know that tax strategy isn't something you think about after the fact: it's part of the initial site selection and pro forma modeling. When we're evaluating land for clients or working through a development opportunity, we're thinking about infrastructure costs, utility access, site work, and how all of that flows through to your returns.

We work with developers who understand that every dollar you save on taxes is a dollar you can deploy into the next deal. If you're looking at development opportunities in Collin, Denton, Dallas, or Tarrant County and want to structure your project with cost segregation in mind from day one, let's talk. We can help you find sites that make financial sense and connect you with the right engineers and CPAs who specialize in these studies.

The Bottom Line

Cost segregation isn't some exotic tax loophole: it's a legitimate, IRS-approved strategy that developers across the country have been using for decades. But with 100% bonus depreciation now permanent and infrastructure costs hitting all-time highs in North Texas, 2026 is an especially powerful year to take advantage of it.

If you're developing land right now and you haven't run a cost segregation study, you're leaving real money on the table. And in this market, that's cash flow you can't afford to miss.

Ready to talk about your next development project? Reach out to our team and let's discuss how to structure your land acquisition and development strategy for maximum cash flow and long-term value.

OUR LISTINGS