Beekeepers AND/OR Land Investors

The "Honeybee Hedge": Why Every Investor is Suddenly a Part-Time Beekeeper

![[HERO] The "Honeybee Hedge": Why Every Investor is Suddenly a Part-Time Beekeeper](https://cdn.marblism.com/l9ybzAMmcMb.webp)

There's a peculiar transformation happening across Collin and Denton counties. High-powered real estate developers, people who spent the last decade leveling pastures and installing cul-de-sacs, have suddenly developed a deep, almost spiritual concern for pollinator health.

They're reading beekeeping manuals. They're attending agricultural seminars. They're joining Facebook groups with names like "North Texas Backyard Beekeepers" and nodding thoughtfully at discussions about Varroa mites.

And in precisely five years, they're going to bulldoze everything and build a subdivision.

Welcome to the world of the Texas agricultural exemption, where honeybees have become the smallest livestock with the biggest ROI.

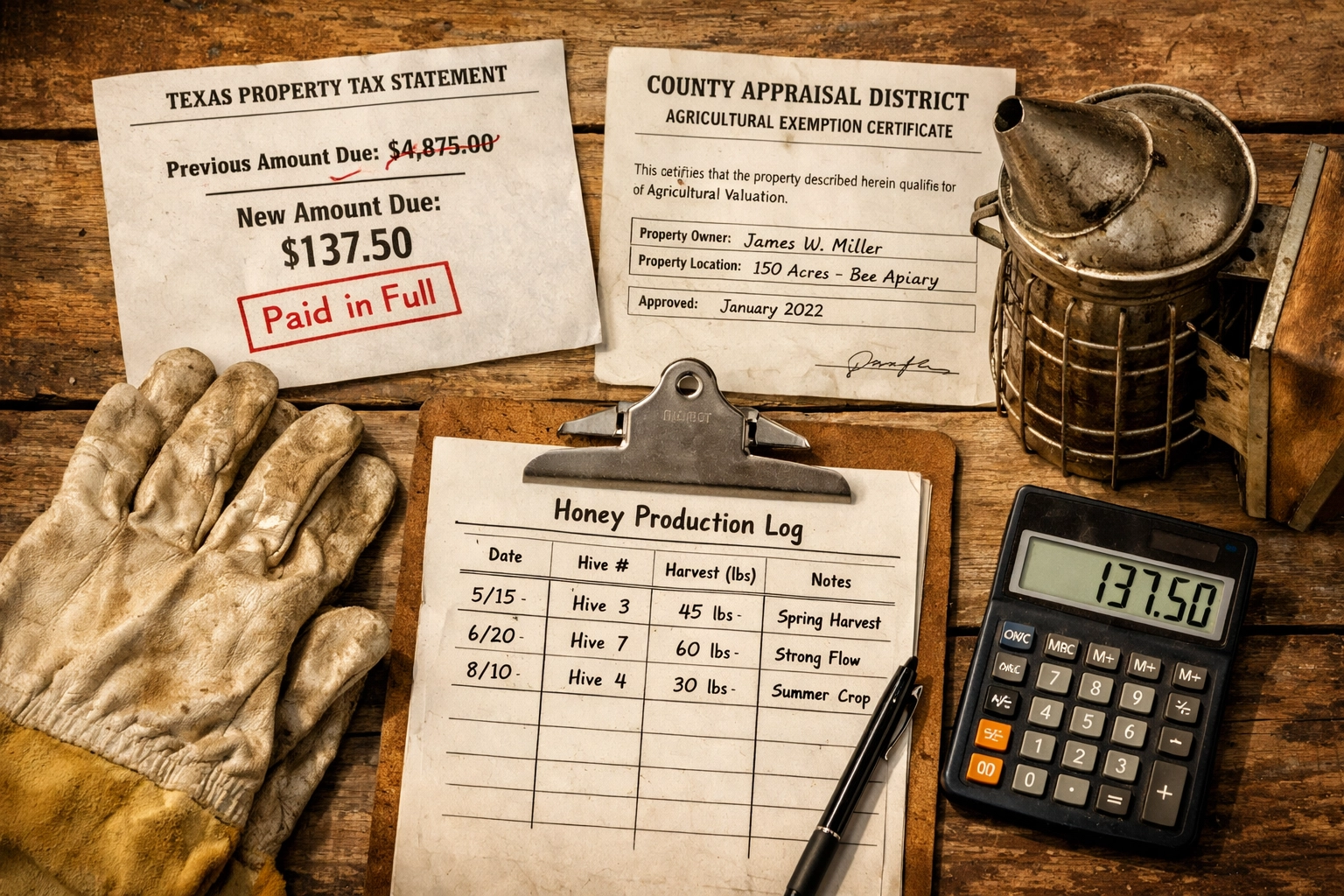

The Cold Math of Sweet Savings

Let's start with the numbers, because that's really what this is about.

A 20-acre tract in prime Collin County, valued at market rate, might carry a property tax bill of $60,000 to $80,000 annually. That same tract, properly qualified for agricultural use under the Texas ag exemption (technically called "1-d-1 Open Space Agricultural Use"), might see taxes drop to $1,500 to $3,000.

Yes, you read that correctly. We're talking about a potential $70,000+ annual savings for maintaining a qualified agricultural operation on land that everyone: including the county appraisal district: knows is destined for development.

The genius of the honeybee strategy is simple: they require relatively little land (as low as 5 acres in some counties), minimal infrastructure, and can be managed by someone who isn't you. Unlike cattle, they won't escape and wander onto Highway 380. Unlike hay production, you don't need expensive equipment or worry about drought years destroying your qualification.

You just need bees. And a straight face when you tell people you're "in agriculture."

Why Honeybees Won the Agricultural Exemption Olympics

Texas law allows for various agricultural activities to qualify for the tax exemption: cattle grazing, hay production, timber management, and yes, beekeeping for pollination or honey production. Each has its own minimum acreage and intensity requirements, which vary by county.

Honeybees emerged as the strategic winner for several reasons:

Low Acreage Minimums: While cattle operations might require 20+ acres to meet intensity of use requirements, beekeeping can qualify on as few as 5-10 acres in many North Texas counties, making it perfect for smaller development tracts.

Minimal Infrastructure: No barns, no fencing, no water troughs. A few hives, some basic equipment, and you're in business. Total startup cost? Usually under $5,000 for a legitimate operation.

Outsourceable Management: Unlike livestock, you can hire a professional beekeeper to manage the operation. They handle the actual work, you handle the property tax savings. It's a beautiful division of labor.

Plausible Deniability: When the appraisal district comes knocking, you can point to active hives, production records, and a legitimate agricultural operation. You're not faking it: you're just deeply committed to both pollinator conservation and your bottom line.

The County-by-County Beekeeping Minimums

If you're considering the honeybee strategy for your North Texas land investment, understand that county appraisal districts have different standards:

Collin County: Generally requires at least 5 acres for beekeeping operations, with a minimum of 6 hives and demonstrated production or pollination activity. They've gotten savvy about "box in a field" operations and will ask for production records.

Denton County: Similar 5-acre minimum, but they've been known to scrutinize operations more heavily given the development pressure. Expect them to verify that your beekeeping operation is genuine and ongoing.

Dallas County: Typically requires 10+ acres for most agricultural exemptions, making beekeeping less attractive than in collar counties, but still viable for larger tracts.

The key phrase across all counties is "degree of intensity generally accepted in the area." You can't put one sad hive on 100 acres and call it agriculture. The operation needs to be proportional and legitimate.

The Five-Year "Pollinator Conservation" Timeline

Here's where the intellectual irony becomes almost poetic.

Most developers acquire land 3-7 years before they're ready to develop it. They're waiting for infrastructure, zoning changes, or market conditions. During that holding period, property taxes are pure expense with no income offset.

Enter the honeybee.

Year 1-5: You are a passionate advocate for pollinator health, deeply concerned about colony collapse disorder, and committed to sustainable agriculture in North Texas. You attend beekeeping workshops. Your LinkedIn might even mention it.

Year 6: Bulldozers arrive. The bees are relocated to another investor's holding tract (the circle of life continues). A sign goes up: "Future Home of Prosperity Meadows - Executive Homes from the $800s."

The appraisal district knows exactly what happened. But you followed the rules. You maintained a legitimate agricultural operation during your holding period. You saved hundreds of thousands in property taxes. And you contributed to local honey production, which is basically a public service.

Everyone wins. Except possibly the bees, but they're getting relocated, not evicted.

The Appraisal District Isn't Stupid (Usually)

Before you order a single bee suit, understand this: Texas appraisal districts have seen every variation of the agricultural exemption game. They've dealt with "wildlife management" plans that consist of one deer feeder, "timber operations" on treeless land, and "beekeeping operations" that are literally one empty box.

They will verify:

- Actual hives and active colonies, not empty equipment

- Production records or pollination services, showing genuine agricultural activity

- Proportional intensity, meaning enough hives for your acreage

- Continuous operation, not something you started two weeks before the appraisal

The rollback tax provision is real. If you lose your agricultural exemption or convert the land to non-agricultural use, you'll owe back taxes for the previous five years: plus interest. The strategy only works if you're actually running a legitimate operation.

This is why most sophisticated investors hire professional beekeeping services. For $2,000-$5,000 annually, you get legitimate hive management, production records, and someone who can actually answer questions when the appraisal district calls. It's not expensive insurance for $50,000+ in annual tax savings.

The Practical Reality for North Texas Land Investors

If you're holding development land in Collin, Denton, or surrounding counties, the Texas agricultural exemption isn't just a "nice to have": it's a fundamental component of your investment math.

Without it, you're paying market-rate property taxes on an asset producing zero income. That's a six-figure holding cost on larger tracts, which directly impacts your IRR and development feasibility.

With a properly structured ag exemption: whether through beekeeping, cattle leasing, or hay production: you're reducing that holding cost to a fraction of market rate. For the relatively minimal expense of maintaining a legitimate agricultural operation, you're preserving tens or hundreds of thousands in capital.

The beekeeping strategy has become popular precisely because it optimizes for the typical development timeline: relatively small tracts (5-40 acres), medium-term holds (3-7 years), and minimal operational hassle.

But here's the critical advice: Don't wing it.

Work with:

- A qualified ag exemption consultant who understands your county's specific requirements

- A legitimate beekeeping professional who can establish and maintain a compliant operation

- A tax advisor who can properly structure the arrangement and document it

The agricultural exemption is a powerful tool for North Texas property tax strategy, but it's not a loophole you can exploit with minimal effort. It's a legitimate tax benefit for legitimate agricultural operations, and the appraisal districts have decades of experience separating the real from the ridiculous.

The Bottom Line on Bees and Development

The "Honeybee Hedge" isn't actually about hedging at all: it's about intelligent tax planning during land holding periods. It's about recognizing that in a high-tax environment like Texas (where we trade income tax for property tax), managing your holding costs is as important as your acquisition and exit strategy.

Is there irony in a developer becoming deeply invested in pollinator health exactly five years before paving everything? Absolutely. But that irony doesn't change the math: a legitimate agricultural operation on development-bound land can save you enough money to cover your acquisition costs, holding expenses, or even your down payment on the next tract.

The honeybee has become the unofficial mascot of North Texas land development not because of some agricultural renaissance, but because smart investors recognized that the smallest livestock could deliver the biggest savings.

Just make sure your operation is real, your documentation is solid, and your beekeeper actually knows the difference between a queen cell and a drone frame. The appraisal district is watching. And unlike the bees, they don't forget.

Considering a land investment strategy in North Texas? Cooper Land Company specializes in land development and strategic acquisitions across Collin, Denton, and surrounding counties. We can connect you with the professionals who make agricultural exemptions work( from appraisal consultants to actual beekeepers.)

OUR LISTINGS