PID vs. MUD: Decoding the Financing Tools Powering North Texas Subdivisions

![[HERO] PID vs. MUD: Decoding the Financing Tools Powering North Texas Subdivisions](https://cdn.marblism.com/F0raLa4HtOR.webp)

If you've looked at a new home in Prosper, Anna, or Princeton lately, you've probably seen the terms "MUD" and "PID" on your tax disclosure forms: and then watched your eyes glaze over trying to figure out what they actually mean.

Here's the deal: these aren't just bureaucratic acronyms. They're the financial tools that make brand-new subdivisions possible in North Texas, and they directly impact what you'll pay every month (or every year) if you buy land or a home in one of these districts.

Let's break down what MUDs and PIDs actually do, how they're different, and why understanding them matters whether you're buying a lot, holding acreage, or trying to figure out if that new neighborhood is worth the sticker shock on property taxes.

What's a MUD? (And Why Do They Exist?)

A Municipal Utility District (MUD) is essentially a mini-government created to finance the essential infrastructure needed to turn raw land into a functioning neighborhood.

When a developer buys 500 acres outside the city limits: say, in the extraterritorial jurisdiction (ETJ) of Anna or Melissa: there's usually no water, sewer, or drainage infrastructure in place. The city isn't going to extend services that far out on their own dime, and the developer can't afford to pay $30 million in cash upfront to build it all.

So they create a MUD. The MUD issues bonds to raise the money for:

- Water and sewer lines

- Drainage systems

- Roads and street infrastructure

- Sometimes parks or recreational facilities

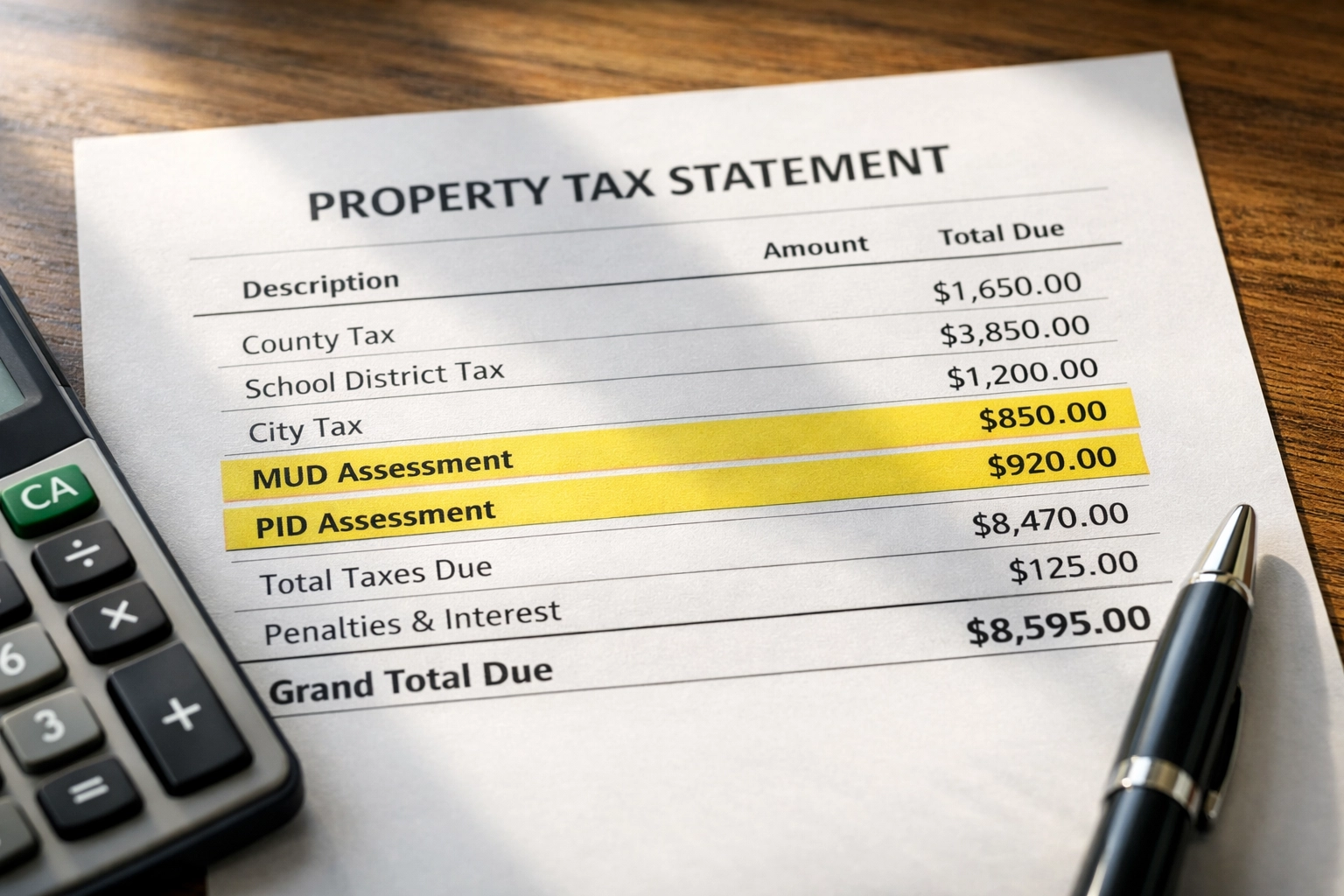

Once the subdivision is built and homes start selling, the homeowners repay those bonds through a higher property tax rate. That MUD tax is a separate line item on your property tax bill, and it usually runs anywhere from 0.5% to 1.2% depending on how much debt the district is carrying.

Over time: usually 20 to 30 years: the bonds get paid off, and the MUD tax rate drops or disappears entirely. But in the early years, you're essentially financing the infrastructure that made your neighborhood possible.

MUD Governance: A Local Board, Not City Hall

Here's what makes MUDs unique: they're independent political subdivisions of Texas, overseen by the Texas Commission on Environmental Quality (TCEQ). Each MUD has its own elected board, typically made up of residents within the district.

That means all the decisions about water rates, maintenance, and bond payments are made locally. If your street floods every time it rains, you can call your MUD board: not the city: and they'll handle it.

This local control can be a good thing when the board is responsive and well-run. It can also be a headache if the board is slow to act or makes decisions you don't agree with. Either way, the MUD operates independently from the city, even if the subdivision eventually gets annexed.

What's a PID? (And How is it Different?)

A Public Improvement District (PID) is a city-controlled assessment district that funds aesthetic and enhancement-level improvements: not the core utilities.

PIDs typically cover things like:

- Entry monuments and signage

- Landscaping and irrigation for common areas

- Decorative lighting

- Parks, trails, and greenbelts

- Ongoing maintenance of those amenities

Unlike MUDs, which are outside city limits, PIDs are inside city limits. The city creates the PID, and the assessment is either collected as a fixed annual charge on your property tax bill or paid as a lump sum at closing.

Here's the key difference: PID assessments are fixed, while MUD taxes are variable.

If your PID assessment is $2,500 per year, that number won't change based on how quickly the bonds are paid off. It's locked in for the life of the PID, which can be 20 to 30 years. Some PIDs allow you to pay off the entire assessment upfront at closing: anywhere from $10,000 to $35,000 depending on the neighborhood: which can be worth it if you plan to stay long-term.

PIDs Are About Curb Appeal, Not Function

Think of PIDs as the "finishing touches" that make a master-planned community look polished. You're not paying for water lines or drainage: you're paying for the manicured median strips, the waterfall feature at the entrance, and the guy who mows the common areas every week.

For buyers, this can be a tough pill to swallow, especially if you're coming from an older neighborhood where HOA dues cover the same stuff for $500 a year. But in new construction, PIDs are becoming standard operating procedure, especially in Collin County.

The Tax Impact: What This Means for Your Monthly Payment

Let's talk numbers, because that's where this gets real.

In a neighborhood without a MUD or PID, your total property tax rate might be around 2.0% to 2.3%. That's the base rate for school district, county, and city taxes.

In a neighborhood with a MUD, your rate could jump to 3.0% to 3.5%. On a $500,000 home, that's an extra $350 to $400 per month in property taxes compared to a similar home without a MUD.

Add a PID assessment on top of that: say, $2,500 per year: and you're looking at another $200+ per month.

For buyers, that can push the total monthly payment (mortgage + taxes + insurance) $500 to $600 higher than they were expecting. For land investors or developers, it's a signal that the infrastructure cost of building in that area is being pushed downstream to the end buyer.

Why This Matters for Land Buyers and Investors

If you're looking at raw acreage or undeveloped lots in a proposed MUD or PID, here's what you need to know:

1. MUDs add value: but they also add carrying cost.

If the land you're buying is inside a newly formed MUD, you'll start paying that higher tax rate as soon as the MUD issues bonds, even if there's no house on the lot yet. That can eat into your hold strategy if you're planning to sit on it for 3 to 5 years.

2. PIDs are a signal of "finished" development.

If a developer is creating a PID, it usually means they're planning a high-end master-planned community with all the bells and whistles. That's great for resale value, but it also means the barrier to entry (and the ongoing costs) will be higher.

3. Not all MUDs are created equal.

Some MUDs are well-managed and pay down their bonds quickly. Others drag on for decades. Before you buy land in a MUD, check the district's debt load, tax rate, and bond payment schedule. The TCEQ website has all this data publicly available: or you can just call me, and I'll pull it for you.

MUD vs. PID: Side-by-Side Comparison

Where You'll Find MUDs and PIDs in North Texas

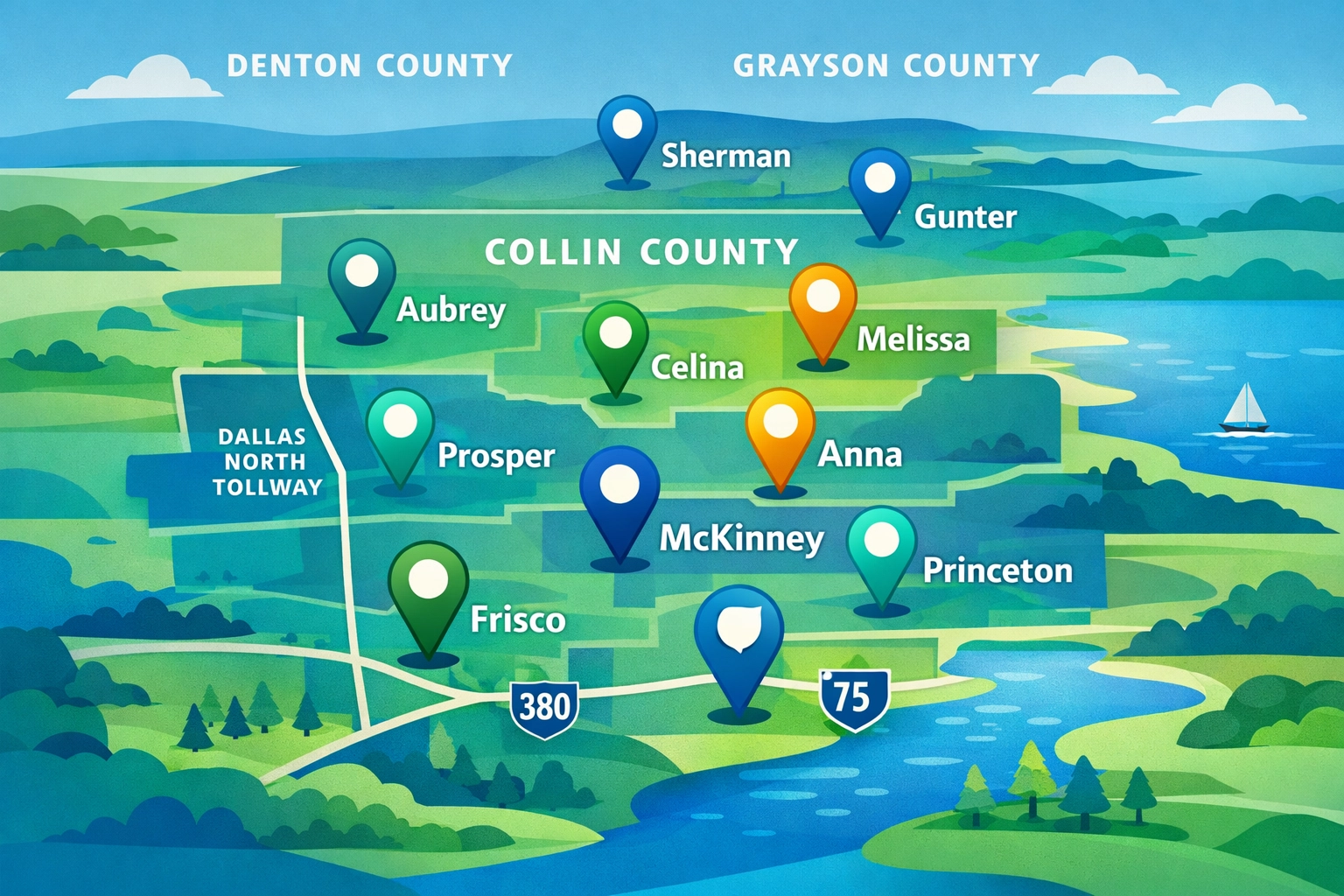

MUDs are most common in fast-growing counties outside major city limits, especially in areas where development is outpacing municipal infrastructure. Think:

- The ETJ of Anna, Melissa, and Prosper (Collin County)

- Unincorporated areas of Denton County (Aubrey, Pilot Point)

- Grayson County near Sherman and Gunter

PIDs are standard in newer master-planned communities within city limits, particularly in:

- Frisco (especially west of the Tollway)

- McKinney (Stonebridge Ranch, Craig Ranch)

- Prosper (Whitley Place, Star Trail)

- Princeton and Celina (anything built after 2020)

If you're looking at land or homes in these areas, there's a good chance you'll encounter one or both.

The Bottom Line: What This Means for You

MUDs and PIDs aren't inherently good or bad: they're just tools developers use to finance growth in areas where the infrastructure doesn't exist yet.

For homebuyers, the key is understanding what you're paying for and whether the higher tax bill is worth it. If you're getting a brand-new home in a top-tier school district with resort-style amenities, the MUD and PID might be a fair trade. If you're looking at a basic production home with minimal upgrades, it might be worth shopping in an older neighborhood without the extra assessments.

For land investors and developers, MUDs and PIDs are just part of the cost structure. The trick is knowing which districts are well-managed, which areas are about to see a wave of new infrastructure, and how to time your entry to maximize value.

At Cooper Land Company, we track MUD formations, bond issuances, and PID proposals across North Texas. If you're evaluating a tract or trying to figure out whether a MUD tax rate is reasonable, we can pull the numbers and give you the full picture.

Because in a market moving this fast, understanding the fine print isn't optional( it's how you stay ahead.)

OUR LISTINGS