Ag-Exemption Audits

Ag-Exemption Audits: Protecting Your Status in 2026

![[HERO] Ag-Exemption Audits: Protecting Your Status in 2026](https://cdn.marblism.com/ty06D_qxRnI.webp)

If you've been holding land in North Texas with an agricultural exemption, you need to hear this: County Appraisal Districts are turning up the heat. The days of a casual phone call or a quick form renewal are over. In 2026, CADs across the region are conducting more thorough audits, asking harder questions, and pulling exemptions that don't meet their increasingly strict standards.

This isn't about being paranoid: it's about being prepared. If you're relying on an ag-exemption to keep your property taxes manageable while waiting for development, rezoning, or the right buyer, losing that status can cost you thousands: sometimes tens of thousands: of dollars in a single year.

Let's talk about what's happening, why it's happening, and most importantly, what you need to do to protect your exemption status.

Why CADs Are Getting More Aggressive

County Appraisal Districts aren't doing this to be difficult. They're responding to two major forces: budget pressure and state scrutiny.

First, local governments are feeling the pinch. Even with recent property tax reforms, counties and school districts need revenue to fund infrastructure, schools, and services. When land values skyrocket (as they have across North Texas), but thousands of acres stay classified as agricultural land paying pennies on the dollar, it creates a tempting target for auditors.

Second, the Texas Comptroller's office has been pushing CADs to tighten up their processes. State audits have revealed inconsistencies in how ag-exemptions are granted and maintained, and CADs are now under pressure to prove they're doing their due diligence.

The result? More site visits, more documentation requests, and more denials for landowners who don't have their paperwork in order.

The Basics: What Qualifies as Agricultural Use

Let's start with the foundation. To qualify for an agricultural exemption in Texas, your land must be "devoted principally to agricultural use to the degree of intensity generally accepted in the area." That's the legal language, and it's intentionally vague.

In practice, this means:

- You must have used the land for agriculture for at least five of the past seven years (for initial qualification)

- The land must be used for a recognized agricultural purpose (raising livestock, growing crops, beekeeping, wildlife management, etc.)

- The agricultural activity must meet minimum "degree of intensity" standards set by your county

Here's where it gets tricky: "degree of intensity" varies by county. What's acceptable in rural Grayson County might not fly in rapidly developing Collin County. CADs in high-growth areas are particularly skeptical of landowners who claim ag-use while clearly holding land for future development.

The "Bees vs. Cows" Strategy

If you've been in the North Texas land game for any length of time, you've heard about beekeeping as an ag-exemption strategy. It's become so popular that it's almost a running joke: until you're the one facing an audit.

Here's the truth: beekeeping absolutely can qualify you for an agricultural exemption. Texas law explicitly recognizes apiculture as an agricultural use. The problem is that too many landowners think they can scatter a few hives on their property, pay a beekeeper a nominal fee, and call it a day.

CADs are wise to this. In 2026, if you're claiming beekeeping, you need to prove:

- You have the minimum number of hives required by your county (typically 6-12 hives per 5-20 acres)

- The hives are actively managed (not just decorative boxes)

- You can produce documentation of honey production, sales, or legitimate agricultural output

- The operation meets the county's intensity standards

We actually covered the beekeeping strategy in depth in a previous article, and those guidelines are even more critical now.

The traditional livestock approach: cattle, goats, sheep: is still the gold standard for ag-exemptions, but it comes with higher carrying costs and management requirements. You need adequate fencing, water sources, and a legitimate stocking rate for your acreage. The upside? CADs rarely question a well-managed cattle operation.

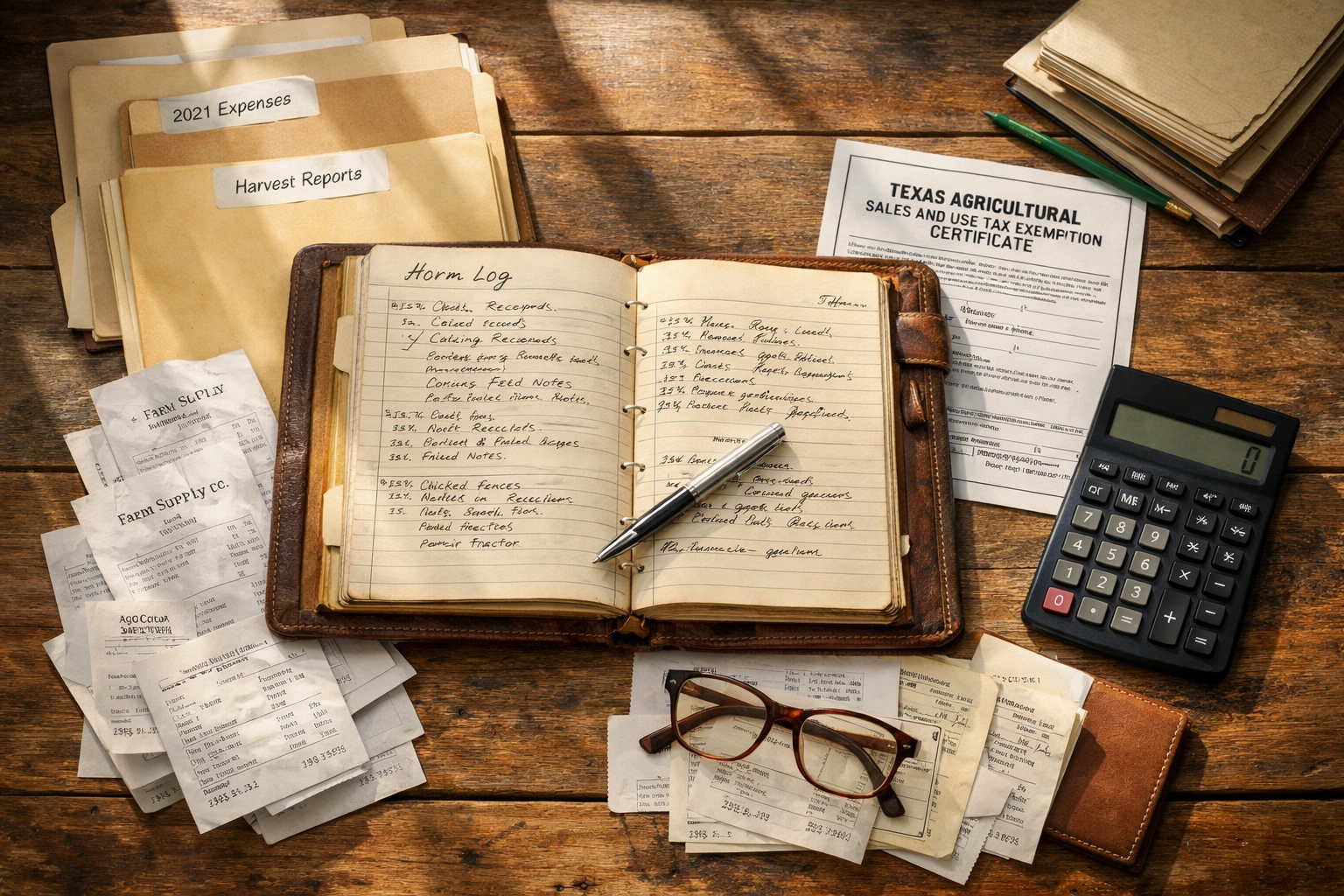

Documentation: What You Need to Have Ready

This is where most landowners get caught off guard. When the CAD sends an audit notice, you typically have 30 days to respond with documentation. If you can't produce the right paperwork, you're in trouble.

Here's what you should have on file and readily accessible:

Income Records: Tax returns showing agricultural income, receipts from sales of livestock or crops, invoices for ag products sold. Even if your ag operation isn't profitable (many legitimate ranching operations aren't), you need to show economic activity.

Expense Records: Receipts for feed, seed, fertilizer, veterinary services, equipment maintenance, and other ag-related expenses. Keep everything. That $200 receipt for cattle mineral supplement might seem trivial, but it proves active management.

Management Logs: Documentation of when you fertilized, when livestock were moved between pastures, when you harvested hay, when bee colonies were inspected. A simple notebook or spreadsheet works fine: just be consistent.

Professional Services: Contracts with beekeepers, livestock managers, or ag consultants. If someone else is managing your ag operation, you need written agreements and proof of payment.

Photos: Time-stamped photos showing your agricultural operation throughout the year. Cattle on the property, active bee boxes, growing crops, maintained fencing: visual evidence matters.

Ag Sales Tax Exemption Number: If you don't have one, get one. It's free from the Texas Comptroller, and it shows you're treating your agricultural operation as a legitimate business.

Red Flags That Trigger Audits

Some situations almost guarantee extra scrutiny from your CAD:

Recently purchased land: If you just bought a property that's been in agricultural use for decades, expect the CAD to verify you're continuing that use: not just coasting on the previous owner's exemption.

Land in the path of growth: If your property is in an area seeing heavy residential or commercial development, CADs assume you're land-banking for eventual sale.

Minimal agricultural activity: If your stocking rate is barely at the minimum threshold, or your beekeeping operation looks suspiciously minimal, you're asking for questions.

No ag income reported: If your tax returns show zero agricultural income year after year, the CAD will question whether you're really engaged in agriculture or just trying to dodge property taxes.

Visible development activity: Surveyors on site, cleared land with no replanting, new roads or infrastructure: anything that suggests preparation for non-ag use raises red flags.

What Happens If You Lose Your Exemption

Let's be blunt: it's expensive. If your ag-exemption is revoked, you'll face:

- Immediate reclassification to market value (which in North Texas could be 10-20 times higher than agricultural value)

- Rollback taxes for the current year plus the previous five years

- Interest penalties on those rollback taxes

- Potentially losing your eligibility to reapply for a certain period

For a 50-acre tract near an expanding city, this could easily mean a $50,000-$100,000 tax bill. It's not something you can ignore or appeal away easily once the determination is made.

Professional Guidance Is Essential

Here's my strongest advice: don't go it alone. The cost of hiring a qualified CPA or ag-exemption consultant is a fraction of what you'll pay if you lose your status.

A good agricultural CPA can:

- Review your current operation and identify weaknesses before the CAD does

- Help structure your ag activities to meet intensity requirements

- Prepare documentation packages that satisfy auditor requirements

- Represent you in appeals if your exemption is challenged

- Advise on transitioning strategies if development is imminent

Look for a CPA who specializes in agricultural taxation and understands Texas property tax law. Generic tax preparers often don't have the expertise to navigate ag-exemption audits.

Similarly, if you're holding land for investment or development, work with a broker who understands these issues. At Cooper Land Company, we've walked dozens of clients through the balance of maintaining ag-exemptions while positioning land for its highest and best use.

The Bottom Line

Agricultural exemptions are a legitimate and valuable tool for Texas landowners. But in 2026, maintaining that status requires real effort, proper documentation, and professional guidance.

If you're currently relying on an ag-exemption, take these steps now:

- Gather all your ag-related documentation from the past five years

- Review your operation against your county's intensity standards

- Schedule a consultation with an agricultural CPA

- Make any necessary adjustments to your operation before audit season hits

- Create a system for ongoing documentation throughout the year

The CADs aren't going to get less aggressive: if anything, expect continued tightening. The landowners who survive scrutiny will be the ones who treat their agricultural operations as genuine businesses, complete with proper management and meticulous records.

Don't wait for the audit notice to arrive. Protect your status now, and save yourself a massive tax headache down the road.

Questions about how ag-exemptions affect your land's value or development timeline? Reach out( we're happy to walk through your specific situation.)

OUR LISTINGS