The Alphabet Soup, PIDs, MUDs, TIRZ and more

The Alphabet Soup of North Texas Land: Navigating MUDs, PIDs, TIRZs, and MMDs

![[HERO] The Alphabet Soup of North Texas Land: Navigating MUDs, PIDs, TIRZs, and MMDs](https://cdn.marblism.com/R6hdBOkqiBw.webp)

If you've been evaluating Texas land for sale: especially in high-growth corridors like Collin and Denton Counties: you've likely encountered a dizzying array of acronyms: MUD, PID, TIRZ, MMD. These aren't just bureaucratic jargon. They represent the financial infrastructure that makes large-scale land development in Texas possible without bankrupting developers or municipalities.

Understanding these special-purpose districts is critical for landowners, developers, and investors looking to capitalize on North Texas's explosive growth. Let's break down what each one does, how many exist in our backyard, and why they create game-changing advantages for those who know how to leverage them.

Decoding the Acronyms

MUD: Municipal Utility District

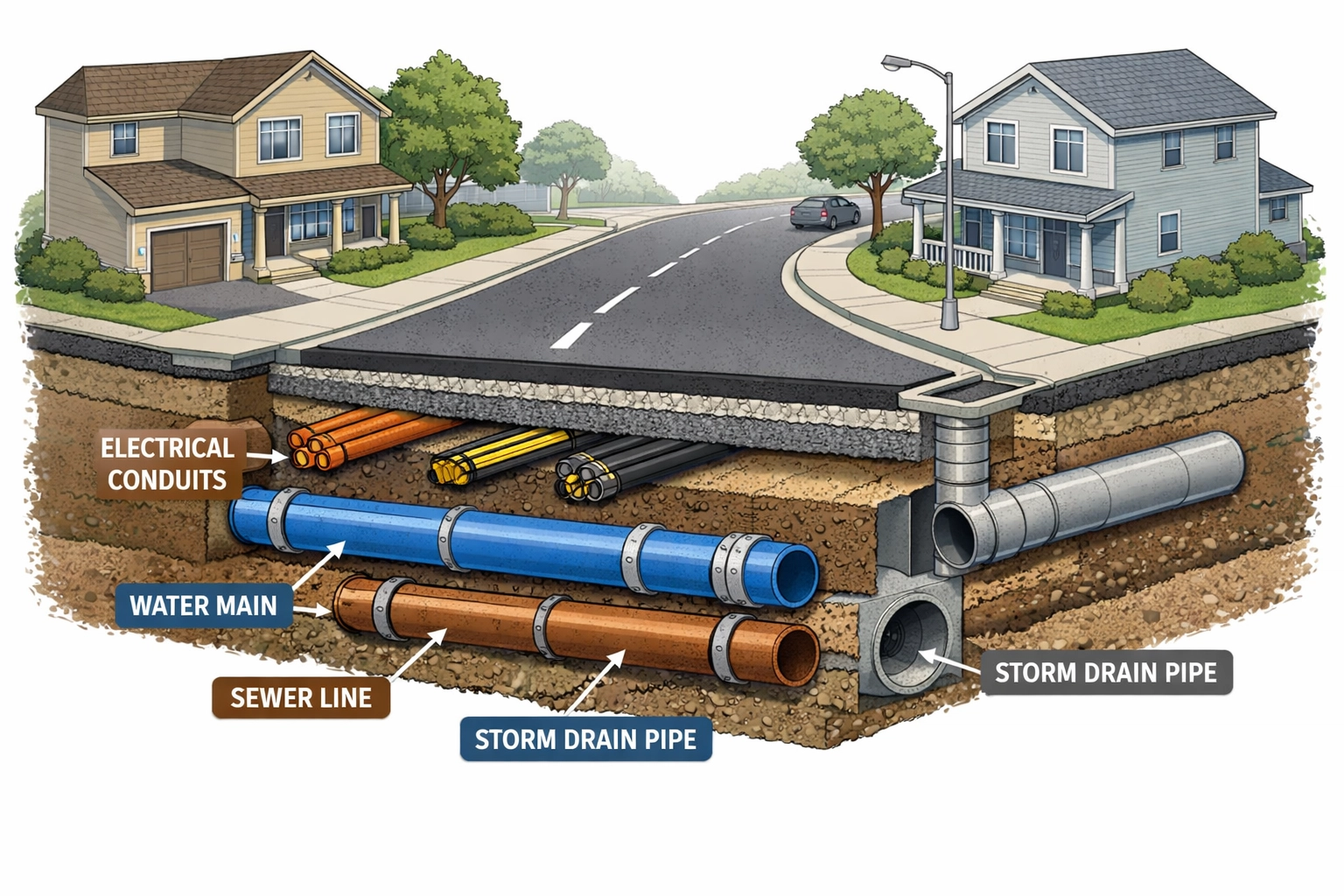

A Municipal Utility District is a political subdivision authorized by the Texas Commission on Environmental Quality (TCEQ) to provide water, wastewater, drainage, and related services to property owners within its boundaries. MUDs operate as independent, limited governments with elected boards of five directors.

These districts are most common in unincorporated areas or on the edges of growing municipalities where extending city utilities would be cost-prohibitive. MUDs issue bonds to fund infrastructure, then repay those bonds through property tax assessments and utility fees on homes and businesses within the district.

PID: Public Improvement District

A Public Improvement District is a defined area where property owners agree to fund specific public improvements: roads, landscaping, streetlights, signage, drainage upgrades: through additional assessments on their tax bills. Unlike MUDs, PIDs don't provide utilities. Instead, they finance the infrastructure and amenities that make a development marketable and functional.

PIDs are typically developer-driven. The developer installs millions of dollars in infrastructure upfront, then creates a PID to recoup those costs over 20–30 years through assessments paid by future homeowners or commercial tenants.

TIRZ: Tax Increment Reinvestment Zone

A Tax Increment Reinvestment Zone (also called a Tax Increment Financing district) captures the increase in property tax revenue generated by new development within a designated zone. The base tax revenue continues flowing to taxing entities (city, county, school district), but the increment: the additional tax revenue from rising property values: is redirected into a fund to pay for infrastructure improvements within that zone.

TIRZs are powerful tools for redevelopment projects or large greenfield developments where upfront infrastructure costs would otherwise stall progress. They effectively allow future tax revenue to pay for today's roads, utilities, and public spaces.

MMD: Municipal Management District

A Municipal Management District is a more comprehensive special district, often used in large mixed-use developments. MMDs can provide a wide range of services: security, landscaping, transit systems, parking facilities, recreational amenities, and even affordable housing initiatives. Think of an MMD as a super-charged PID with broader powers and longer-term planning authority.

MMDs are less common than MUDs or PIDs but are increasingly popular in master-planned communities and urban redevelopment zones where a higher level of ongoing management is required.

North Texas: The Epicenter of Special Districts

Texas is home to over 1,000 special-purpose districts, with MUDs alone accounting for approximately 900–1,000 active districts statewide. North Texas: specifically Collin and Denton Counties: represents a disproportionately large share of this total.

Why? Because North Texas sits at the intersection of explosive population growth, abundant land for development, and municipalities that lack the capital or bonding capacity to extend utilities into rapidly expanding suburban and exurban areas.

Collin County alone has dozens of active MUDs, with new districts being created each year to support residential subdivisions in cities like Prosper, Celina, Princeton, and Anna. Denton County mirrors this trend, particularly in communities along the US-380 and I-35E corridors.

PIDs are equally ubiquitous. Celina, Texas: one of the fastest-growing municipalities in the United States: has become a textbook case for PID-driven development. The city has over a dozen active PIDs powering subdivisions like Mustang Lakes, Cambridge Crossing, Legacy Hills, Light Farms, and Ridgeview. Each of these communities relies on PID assessments to fund the roads, entry monuments, trails, and drainage systems that attract homebuyers willing to pay premium prices.

TIRZs and MMDs are less common but growing. Cities like Frisco, McKinney, and Plano have used TIRZs to catalyze mixed-use developments and urban infill projects. MMDs are beginning to appear in large-scale master plans where long-term district management justifies the added complexity.

The Developer Advantage: Turning Dirt into Deals

For developers, these financing mechanisms are nothing short of transformative. Here's why:

Capital Efficiency

Building roads, water lines, sewer infrastructure, and drainage systems for a 500-acre subdivision can cost $30 million or more. Without MUDs or PIDs, developers would need to front that entire cost and wait years to recover it through lot sales. MUDs and PIDs allow developers to finance infrastructure through bonds, which are repaid over time by the homeowners or businesses that move in.

This means developers can deploy capital more efficiently: acquiring more land, building more phases simultaneously, or pursuing additional projects instead of locking up tens of millions in a single development.

Risk Mitigation

Infrastructure costs are one of the largest financial risks in land development in Texas. If a developer self-funds all improvements and the market softens, those sunk costs become unrecoverable losses. MUDs and PIDs shift much of that risk onto future property owners, who pay for infrastructure through ongoing assessments as they enjoy the benefits of completed improvements.

Faster Project Velocity

PID reimbursements and MUD bond proceeds allow developers to move faster. Roads get paved. Water towers go up. Detention ponds get dug. Without waiting for municipal budgets or multi-year capital improvement plans, developers can deliver finished lots to builders in 18–24 months instead of 36–48 months.

Speed matters. In high-growth markets like Celina or Prosper, being first to market with finished lots can mean the difference between achieving premium pricing and competing in a saturated field.

The Landowner Advantage: Unlocking Value

If you own raw Texas land for sale in the path of growth, MUDs and PIDs aren't just developer tools: they're value multipliers for your dirt.

Development Feasibility

Unimproved land without water, sewer, or road access is worth a fraction of what development-ready land commands. MUDs make it financially feasible for developers to bring those utilities to your property, transforming agricultural or ranch land into subdivisions, business parks, or mixed-use projects.

For landowners negotiating sale terms or joint ventures, the ability to form a MUD or PID often determines whether a deal pencils at all. No MUD? The developer walks. MUD approved? Your land just became the next hot acquisition target.

Premium Pricing

Development-ready land commands 5x to 10x the per-acre price of raw land. When a MUD or PID eliminates the infrastructure funding gap, your land moves from speculative to shovel-ready. That shift translates directly into higher offers and faster closings.

Landowners who understand how to position their property for MUD or PID formation: working with legal counsel and engineers to secure annexation agreements or preliminary utility studies: can capture significantly more value than those selling raw dirt with no development pathway.

Annexation Leverage

Many landowners in North Texas face annexation pressure from adjacent municipalities. MUDs and PIDs can serve as negotiating tools. By demonstrating that a development is financially viable through district formation, landowners and developers gain leverage in annexation discussions, often securing more favorable development agreements, density allowances, or zoning concessions.

Navigating the Complexity

Here's the reality: MUDs, PIDs, TIRZs, and MMDs are powerful, but they're also legally complex, politically sensitive, and administratively demanding. Formation requires:

- TCEQ approval (for MUDs)

- City council or county commissioners' court consent (for PIDs and TIRZs)

- Detailed engineering studies and financial feasibility analyses

- Coordination with school districts, water authorities, and other taxing entities

- Voter approval in some cases

Missteps in the formation process can delay projects by years or kill deals entirely.

That's where experience matters. At Cooper Land Company, we've worked on both sides of these transactions: representing landowners positioning property for development and advising on acquisitions where MUD or PID formation is critical to feasibility. We understand the timelines, the stakeholders, and the financial mechanics that turn alphabet soup into closed deals.

The Bottom Line

North Texas is being built on the backbone of MUDs, PIDs, TIRZs, and MMDs. These districts aren't obstacles: they're accelerants. They allow developers to build at scale without crushing capital requirements. They allow landowners to unlock value that would otherwise remain buried in unimproved acreage. And they allow municipalities to grow without exhausting bond capacity or raising taxes on existing residents.

If you own land in Collin, Denton, or the surrounding counties, understanding how these districts work isn't optional: it's essential to maximizing your land's value and positioning it for the right buyer at the right time.

Whether you're evaluating Texas land for sale, planning a development project, or exploring land acquisition services to assemble the next major tract, the question isn't whether special districts will be part of the equation. The question is whether you have the expertise to navigate them.

Cooper Land Company does. Let's talk about your land and what these tools can unlock. Contact us today to discuss your property and the development potential waiting beneath the surface.

OUR LISTINGS