Infrastructure Lag

Infrastructure Lag: The Real Reason North Texas Home Prices Won't Crater

![[HERO] Infrastructure Lag: The Real Reason North Texas Home Prices Won't Crater](https://cdn.marblism.com/m9KlsN6vggo.webp)

Everyone's talking about interest rates. Every headline screams about the Fed, mortgage rates, and affordability. And sure, those matter. But if you're waiting for North Texas home prices to crater because rates ticked up, you're missing the real story.

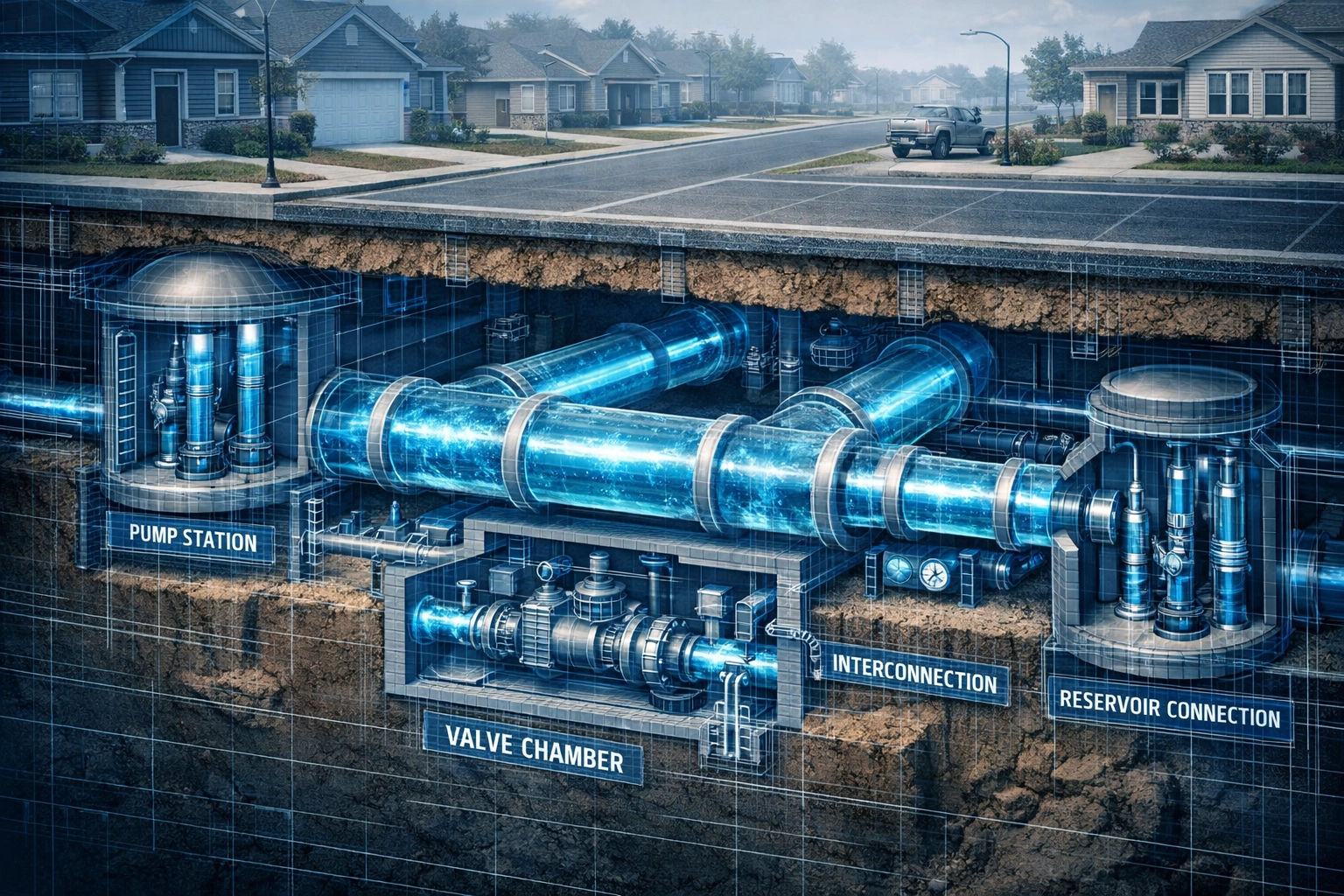

The truth? Interest rates are just the noise. The real constraint, the one keeping a hard floor under land values and home prices across North Texas, is infrastructure. Specifically, the stuff nobody wants to talk about at cocktail parties: water lines, sewer capacity, and road access.

You can have all the capital in the world and the lowest rates imaginable, but if you can't get water to a piece of dirt, you've got an expensive pasture. And right now, across Grayson, Denton, and much of the North Texas region, we're dealing with a massive shortage of truly shovel-ready land.

The "Shovel-Ready" Myth

Let's define terms. When developers and investors talk about "shovel-ready" land, they mean tracts where utilities are already in place or immediately accessible, where road infrastructure can handle the traffic load, and where regulatory approvals are either secured or straightforward. It's land where you can literally break ground within months, not years.

In North Texas, that kind of land is vanishingly rare, and getting rarer by the day.

Here's why: the region has been adding roughly 150,000 to 200,000 people per year for the last decade. That's the equivalent of dropping a new city the size of Frisco into the Metroplex every single year. And while the private sector has responded aggressively on the housing side, the public infrastructure required to support that growth, the pipes, pumps, treatment plants, and pavement, takes years to plan, fund, and build.

The result? A massive gap between the land that looks developable on a map and the land that's actually developable today.

Water: The Silent Kingmaker

Let's start with water, because it's the single biggest constraint right now.

The North Texas Municipal Water District (NTMWD) is committing $1.7 billion in 2026 alone to expand water supply capacity. That's not a typo. Over $1.3 billion of that is dedicated specifically to water supply improvements, including the "Texoma Two-Step" program, which will add approximately 90 million gallons per day of pipeline capacity by 2029.

That's great news for the long-term future of the region. But here's the catch: those improvements are being built to serve future demand, not today's. And in the meantime, many utilities and municipal utility districts (MUDs) across Grayson and Denton counties are at or near capacity.

If you're a developer who just closed on 200 acres outside of Anna or west of Aubrey, congratulations, you now own land. But until the water tap gets approved, you're not building homes. And if the local utility district tells you they're at capacity and won't issue new taps until 2028, well, you've just turned a two-year project into a five-year hold.

This isn't a theoretical problem. It's happening right now across dozens of tracts in high-growth corridors. Developers are sitting on land they paid top dollar for, waiting for infrastructure that's still two to four years out. And while they wait, they're not flooding the market with new supply, which means prices stay elevated.

The Sewer Story

If water is the kingmaker, wastewater treatment is the gatekeeper.

Expanding wastewater capacity is even more capital-intensive and politically complex than water supply. Treatment plants require significant land, regulatory approvals, and ongoing operational expertise. Many smaller cities and MUDs across North Texas are running their treatment facilities at or above design capacity, which means no new connections until they can fund and build expansions.

In some cases, developers have resorted to building private wastewater treatment facilities just to unlock land for development. That's a multi-million-dollar cost that gets baked into the land basis: and ultimately into home prices.

The NTMWD is investing over $250 million in an expanded pump station and pipeline to serve rapidly growing eastern communities like Farmersville, Josephine, and Nevada. But again, those projects take years to design, permit, and construct. In the meantime, land that could theoretically support 500 homes sits idle because the infrastructure isn't there yet.

Roads: The Final Bottleneck

Even if you solve water and sewer, you still need road access. And not just any road: you need roads that can handle the traffic load of a new subdivision or commercial center without creating a political firestorm among existing residents.

The Regional Transportation Council recently approved the $217.3 billion Mobility 2050 long-range plan, with $97.5 billion earmarked for freeways and $57.9 billion for rail and transit. The DFW Metroplex is receiving $47 billion of that total, focused heavily on highway expansion and corridor improvements like I-35 and the areas around DFW Airport.

Those are massive investments, and they'll eventually unlock huge swaths of land for development. But here's the timing issue: many of those projects won't be completed until the late 2020s or early 2030s. Which means land along those future corridors is valuable, but it's not developable today.

Meanwhile, developers are paying premiums for tracts along existing highway corridors where road capacity already exists or can be expanded relatively quickly. That competition for the limited pool of truly accessible land keeps prices high.

Why Grayson and Denton Counties Are Ground Zero

Grayson and Denton counties are perfect case studies for this infrastructure bottleneck.

Both counties have seen explosive growth over the last five years, driven by their proximity to the Metroplex, relatively affordable land, and strong school districts. But their infrastructure: much of it built decades ago for populations a fraction of today's size: is struggling to keep pace.

In Grayson County, cities like Sherman, Denison, and Anna are racing to expand water and sewer capacity to accommodate new development. But until those expansions come online, the supply of shovel-ready residential tracts remains constrained. Developers know the growth is coming, so they're not selling at distressed prices. They're holding, waiting for the infrastructure to catch up.

Denton County faces similar challenges, particularly in the rapidly growing western and northern portions of the county. Towns like Argyle, Northlake, and the expanding edges of Denton itself are dealing with capacity constraints that limit the pace of new development.

The result? Land values in both counties have remained remarkably stable despite broader market volatility. Because even if interest rates rise or housing demand softens temporarily, the underlying supply constraint created by infrastructure lag puts a floor under prices.

The Developer's Dilemma

Here's the math developers are facing:

They can buy raw land today at prices that reflect future development potential. But they can't start building until the infrastructure arrives. And while they wait, they're carrying land costs: property taxes, debt service, opportunity cost: with no revenue coming in.

In some cases, developers are choosing to pay premiums for tracts that already have water, sewer, and road access, even if those tracts are more expensive per acre. Why? Because they can start building now and start generating returns now, rather than sitting on raw land for three to five years waiting for a water line extension.

This dynamic is creating a two-tiered land market: shovel-ready tracts command premium pricing, while tracts that need infrastructure are trading at relative discounts: but not the kind of discounts you'd see in a true market crash. Because everyone knows the infrastructure is coming eventually, and when it does, those tracts will unlock.

What This Means for Investors

If you're an investor or developer looking at North Texas land, the lesson is simple: due diligence on infrastructure isn't optional anymore. It's the single most important factor in determining whether a tract is truly viable.

You need to know:

- What water and sewer capacity exists today, and what's planned

- What the timeline is for any planned expansions

- Whether the local utility has the financial capacity to actually deliver those projects

- What the road access situation looks like, both today and in five years

- Whether there are any regulatory or environmental constraints that could delay development

This is where strategic guidance becomes critical. A tract that looks perfect on paper: great location, good price, clean title: can turn into a nightmare hold if the water district won't issue taps for another four years. On the flip side, a tract that seems expensive today might actually be a steal if it's one of the few parcels in the area with immediate utility access.

At Cooper Land Company, this kind of infrastructure analysis is baked into every evaluation we do. We're not just looking at market comps or zoning: we're talking to utility districts, reviewing capital improvement plans, and tracking road projects to understand what's truly developable and what's just wishful thinking.

The Bottom Line

Interest rates will go up and down. Market sentiment will shift. But infrastructure constraints are structural and slow-moving. The North Texas region is investing tens of billions of dollars to expand capacity, but those projects take years to deliver.

In the meantime, the shortage of shovel-ready land keeps a floor under prices. Developers can't build what doesn't have water, sewer, and road access. And until the infrastructure catches up to demand, the supply of truly developable tracts will remain constrained.

That's not a bug in the North Texas market. It's a feature. And it's the real reason home prices aren't going to crater, no matter what the headlines say about interest rates.

If you're serious about land investment or development in Grayson, Denton, or anywhere across North Texas, let's talk. Understanding the infrastructure piece isn't just helpful: it's the difference between a smart investment and an expensive mistake.

Reach out to Cooper Land Company to discuss how we can help you identify truly viable tracts in this evolving market.

OUR LISTINGS