Conservation Easements: The 'Patient' Investor's Tax Strategy

![[HERO] Conservation Easements: The 'Patient' Investor's Tax Strategy](https://cdn.marblism.com/_ZIQQlajRu6.webp)

If you're sitting on 100+ acres in the path of growth but know it's a 10–15 year hold before you can actually do anything with it, you've got a problem: carrying costs.

Property taxes, loan payments, insurance, maintenance, it all adds up while you're waiting for the path of progress to arrive. For guys in North Texas holding land in places like Wise County, western Denton County, or the rural stretches of Grayson County, the annual burn can get expensive.

That's where conservation easements come into play.

Most people think of conservation easements as something for tree-huggers or generational ranches trying to "preserve the family legacy." And while that's part of the story, there's another angle: conservation easements are one of the most powerful tax tools available for patient land investors.

If you're willing to wait on development, and let's be honest, if you're holding raw land in North Texas, you're already waiting, a conservation easement can dramatically reduce your carry costs while you sit on the asset. Let me walk you through how it works.

What is a Conservation Easement?

A conservation easement is a legal agreement where you voluntarily restrict certain uses of your land, usually development, in exchange for a significant tax deduction. You still own the land. You can still use it for farming, ranching, hunting, or recreation. You just agree not to subdivide it or build a bunch of houses on it.

The easement is donated to a qualified conservation organization (a land trust, government entity, or certain nonprofits), and in return, you get a charitable deduction based on the diminished value of the property. The IRS allows you to deduct the difference between what the land was worth before the easement and what it's worth after.

Here's the key: the easement is permanent. It runs with the land, so future owners are bound by the same restrictions. That's what makes it a legitimate charitable donation in the eyes of the IRS, you're giving up something of value forever.

The Federal Tax Play

The federal income tax deduction is where this strategy gets interesting for land investors.

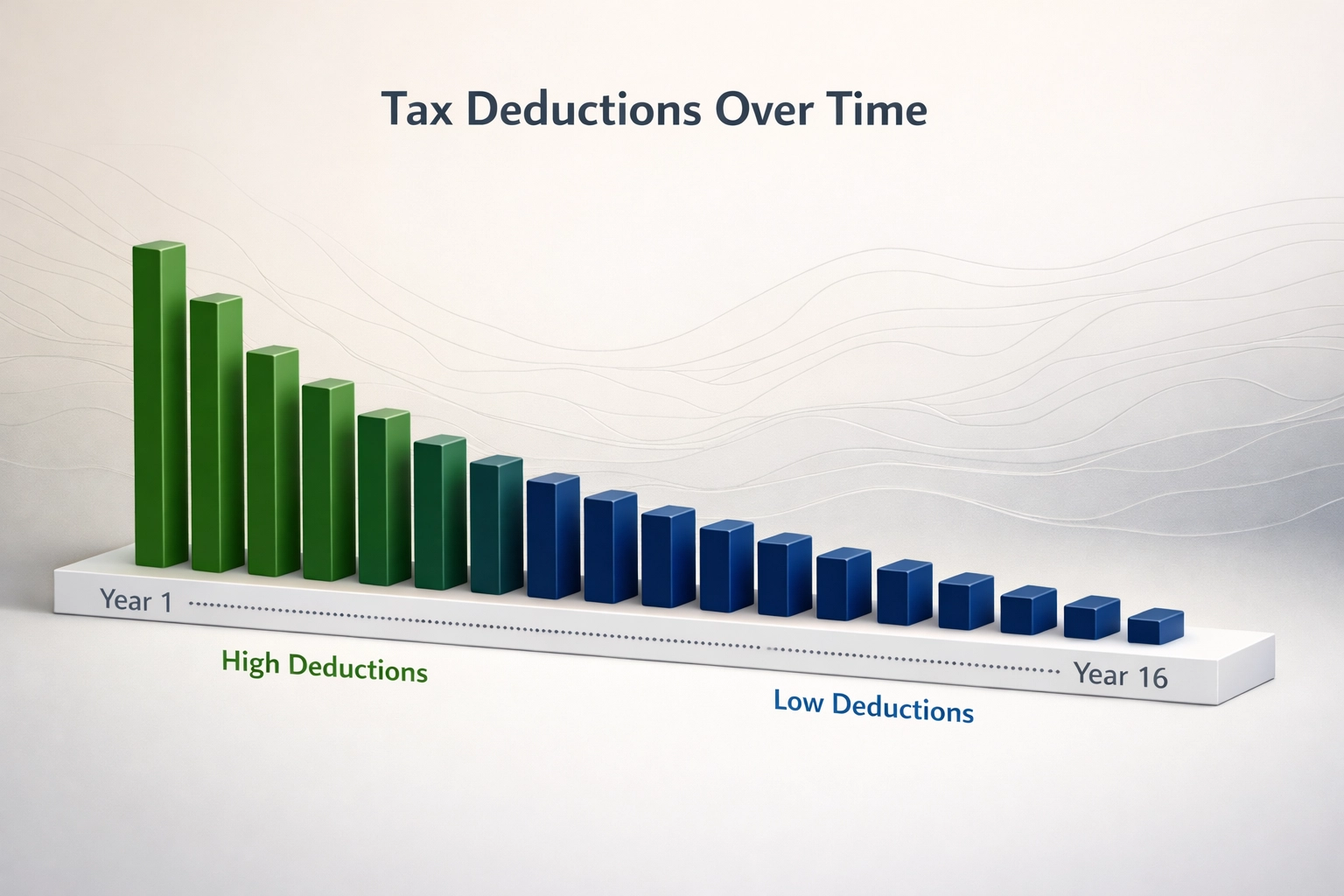

Under current IRS rules, you can deduct up to 50% of your adjusted gross income (AGI) annually for up to 16 years. If you're a farmer or rancher, you can deduct up to 100% of your AGI annually over the same 16-year window.

Let's say you donate an easement that appraises at a $2 million reduction in value. If your AGI is $150,000 per year, you can deduct $75,000 annually (50% of AGI) for up to 16 years, that's $1.2 million in total deductions. The rest carries forward until you use it all up.

That's a massive offset against income while you're holding the land and waiting for the market to catch up.

Beyond Federal: State Credits and Estate Benefits

In addition to the federal deduction, some states offer tax credits for conservation easements. Texas doesn't currently have a state income tax, so we don't benefit from that angle, but if you're holding land in multiple states (Oklahoma, Arkansas, New Mexico), some of those jurisdictions do offer credits that can further enhance the value of the strategy.

The estate tax angle is another big one. Under IRC Section 2031(c), heirs can exclude up to 40% of the restricted land's value from the taxable estate. For guys holding large tracts in the family and thinking about generational succession, that's a huge tool for reducing the estate tax burden when it's time to pass the land down.

And don't forget property taxes. While Texas doesn't offer automatic property tax exemptions for conservation easements, keeping the land under ag exemption (which is easier when you're restricting development) can still help manage the annual carry.

Why This Works for Patient Investors

The beauty of this strategy is that it's built for long-term holders, exactly the profile of most serious North Texas land investors.

Let's say you bought 200 acres in western Wise County in 2023 for $8,000/acre. You know it's not getting utilities or seeing developer interest for at least another decade. But you're confident that by 2035, when Decatur starts really expanding west, that land could be worth $25,000–$30,000/acre.

In the meantime, you're paying $40,000/year in property taxes, debt service, and upkeep. That's $400,000 over 10 years, before you see a dime of appreciation.

Now imagine placing a conservation easement on 150 of those 200 acres. You keep 50 acres unrestricted for a future homesite or small cluster development. The easement appraises at a $1.5 million reduction in value. You take the federal deduction over 10 years, saving $400,000–$500,000 in income taxes (depending on your bracket and AGI).

You've effectively offset the entire cost of holding the land.

And here's the kicker: when 2035 rolls around and the path of growth arrives, you still own the land. The 50 unrestricted acres can be developed. The remaining 150 acres? They stay preserved: but they also stay in your estate, they still have value as recreational or agricultural land, and you've already captured the tax benefit.

The Qualification Checklist

Not every property qualifies for a conservation easement. The IRS has specific requirements, and you'll need to jump through a few hoops to make sure the deduction holds up.

First, the easement must serve one of four approved conservation purposes:

- Protecting natural habitats or ecosystems

- Preserving land for outdoor recreation or education

- Preserving open space (including farmland and forestland)

- Preserving historically important land or structures

In North Texas, most easements fall under the "open space" or "habitat protection" categories. If your land has significant tree cover, creek frontage, or serves as wildlife habitat, you're likely in good shape.

Second, the easement must be donated to a qualified organization. This could be a land trust (like the Texas Land Conservancy), a government entity, or a qualified 501(c)(3) nonprofit. The organization has to have the resources and commitment to monitor and enforce the easement in perpetuity.

Third, you'll need a professional appraisal to establish the reduction in value. The IRS is very picky about this: the appraiser needs to be qualified, the methodology needs to be sound, and the valuation needs to reflect a legitimate before-and-after comparison. Expect to spend $10,000–$20,000 on a quality appraisal for a large tract.

Finally, you'll report the donation on Form 8283 as a non-cash charitable contribution. If the deduction exceeds $5,000, you'll need a qualified appraisal attached. If it exceeds $500,000, you'll need an additional IRS filing.

The North Texas Context

Here's where this gets specific to our region.

North Texas is in a weird spot right now. We've got explosive growth in some areas: Prosper, Celina, Anna: but we've also got vast stretches of land that are still 10–20 years away from seeing real development pressure. Places like western Denton County, northern Wise County, and the rural parts of Grayson County fall into that category.

If you're holding land in these "next wave" areas, you're essentially betting on long-term appreciation. You believe the path of growth is coming, but you're realistic about the timeline. You're not expecting a developer to knock on your door in 2026: you're thinking 2035 or 2040.

That makes you the perfect candidate for a conservation easement strategy.

You can place the easement now, take the deduction over the next 10–15 years, reduce your carry costs, and still position yourself (or your heirs) to benefit when the appreciation finally hits. You might even keep a portion of the tract unrestricted so you can participate in the upside when development does arrive.

When It Makes Sense (and When It Doesn't)

Let's be clear: this isn't a strategy for every land deal.

If you're sitting on 20 acres with frontage on US-380 and a developer is already circling, don't put a conservation easement on it. You're about to realize the full development value of that land: don't cap it for a tax deduction.

But if you're holding a large tract (100+ acres) in a rural area, you've got a long time horizon, and you're bleeding cash on carrying costs? That's when this strategy shines.

It's also worth noting that you give up flexibility. Once the easement is in place, you can't change your mind. Future owners are bound by the same restrictions. So you need to be very intentional about which portions of the land you restrict and which you leave open for future development.

The Bottom Line

Conservation easements aren't for everyone, but for patient investors holding large tracts in North Texas, they can be a game-changer.

You lower your annual carry costs, you protect against estate taxes, and you still own the land when the path of growth finally arrives. It's a way to make the "waiting period" more financially manageable: and in a market where holding land for 10–15 years is increasingly common, that's a big deal.

If you're sitting on a large tract and wondering how to make the math work while you wait, it's worth a conversation. We work with guys on these strategies all the time, and we can help you think through whether it makes sense for your specific situation.

Reach out if you want to talk through the details. We've seen this play work for the right investors; and in North Texas, patience still pays.

OUR LISTINGS