The 'Secondary Market' Sweet Spot: Wise and Parker Counties

The 'Secondary Market' Sweet Spot: Wise and Parker Counties

![[HERO] The 'Secondary Market' Sweet Spot: Wise and Parker Counties](https://cdn.marblism.com/m7BLd58yMjK.webp)

There's a pattern playing out across North Texas that every serious land developer has seen before: a primary market hits critical mass, pricing goes parabolic, and suddenly the "next county over" becomes the smartest play on the board.

Right now, that's Wise and Parker Counties.

While Collin and Denton Counties continue their ascent into the stratosphere: with raw land prices that make even seasoned developers wince: a significant shift is underway just to the west. Residential developers hunting for 50-200 acre tracts are pivoting hard toward Wise and Parker, and for good reason: the numbers finally make sense again.

The Collin/Denton Squeeze

Let's call it what it is: Collin and Denton Counties have become prohibitively expensive for all but the most capitalized groups. When raw land is pushing $100,000+ per acre in prime development corridors, your margins evaporate fast: especially when you're factoring in horizontal infrastructure costs, utility tap fees, and the reality that your end-user homebuyer can only stretch so far.

The math is brutal. A 100-acre tract in Prosper or Celina that might have penciled at $8-10 million five years ago is now commanding $12-15 million or more. Add in the cost of getting dirt to "finished lot" status: roads, water, sewer, drainage: and you're looking at an all-in basis that only works if you're delivering $500K+ homes. That's a shrinking buyer pool, even in North Texas.

So what do smart developers do? They go where the fundamentals still work.

Enter the Secondary Market

Wise and Parker Counties aren't "secondary" because they're inferior: they're secondary because they're next. The infrastructure is following the growth, not leading it, which means there's still an opportunity window for developers who can read the tea leaves.

Here's what makes these markets compelling right now:

Parker County is commanding a median land price of roughly $44,000 per acre, with homes selling at a median of $449,000. It's established, it's connected, and it's close enough to Fort Worth that the commute doesn't feel punitive. Weatherford has become a legitimate draw for families seeking the "small town with big city access" formula, and communities like Willow Park offer direct I-20 access that puts downtown Fort Worth 30 minutes away.

Wise County is the value play, with land averaging around $28,000 per acre and median home prices at $360,000. It's further out, sure, but for developers targeting first-time buyers or move-up families priced out of Collin County, Wise offers the margin cushion needed to make deals pencil. Homes are selling in 72 days on average: a healthy clip that signals real demand, not speculative froth.

The 50-200 Acre Sweet Spot

Here's where it gets interesting. The ideal development tract size in these markets is falling right into the 50-200 acre range, and there's a specific reason for that.

Too small: say, under 50 acres: and you're dealing with fragmented infrastructure costs that kill your per-lot economics. Too large: over 200 acres: and you're taking on a multi-phase, multi-year project that ties up capital and increases execution risk in a market that's still maturing.

But 50-200 acres? That's the Goldilocks zone. You've got enough scale to justify the upfront infrastructure investment, you can deliver lots in 12-24 months, and you're not betting the farm (literally) on a single mega-project that takes five years to absorb.

We're seeing consistent demand from regional and national homebuilders looking for exactly this profile. They want entry-level and move-up product in the $300K-$500K range, and Wise and Parker are delivering the land basis that makes those price points work. In Collin County, you'd need to be building $600K+ homes to justify the land cost. In Parker and Wise, you can still hit the broader market.

Infrastructure: The Real Story

Let's talk about what actually matters: pipes, pavement, and power.

Parker County benefits from established utility infrastructure, particularly around the Weatherford and Willow Park areas. Water and sewer capacity aren't the chokepoint they are in some fringe markets, and the major road corridors: I-20, US 180, FM 51: are already built out. That means a developer isn't gambling on whether TxDOT will widen a highway in five years; the bones are already there.

Wise County is a bit more of a frontier play, but that's changing fast. Decatur and the eastern portions of the county are seeing real utility investment as municipalities recognize the growth pressure migrating north and west from Denton. For developers willing to work with Municipal Utility Districts (MUDs) or to front some of the initial infrastructure costs, the land basis is low enough to absorb it and still deliver competitive returns.

The key insight here: infrastructure lag is actually an advantage if you're positioned correctly. It means competition is still limited, and the developers who can navigate the entitlement and utility process are getting rewarded with better land pricing and fewer bidding wars.

The ROI Case

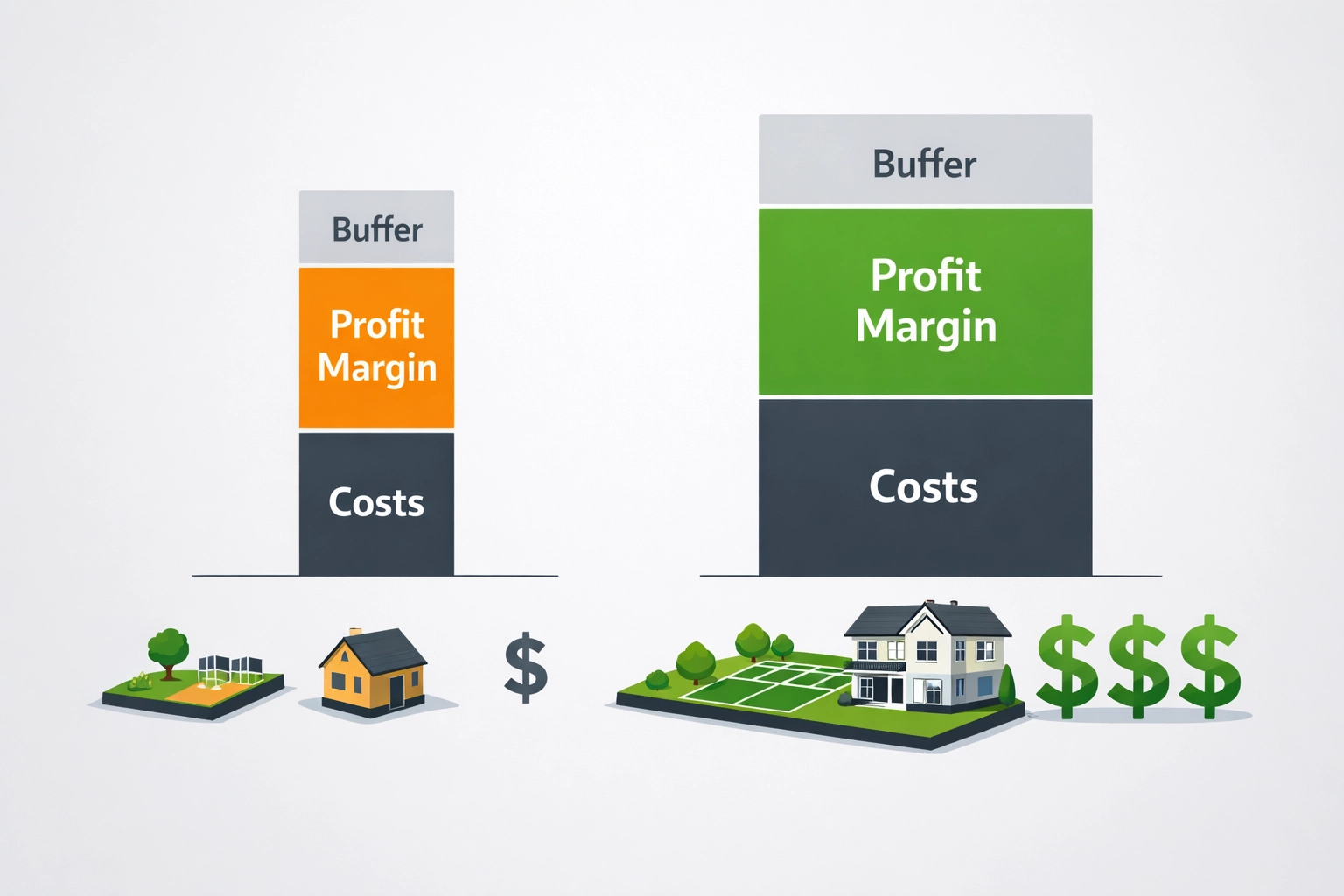

So why are we calling this the "sweet spot" for ROI? Because the risk-adjusted returns in Wise and Parker are currently outperforming Collin and Denton for residential land development.

Consider a hypothetical 100-acre tract:

- Collin County: $10-12 million acquisition, all-in development cost of $16-18 million, delivering 200 lots at $90K-$100K per lot. Gross revenue: $18-20 million. Margin: slim, especially if absorption slows.

- Parker County: $4-5 million acquisition, all-in development cost of $8-10 million, delivering 200 lots at $70K-$80K per lot. Gross revenue: $14-16 million. Margin: significantly better, with downside protection if the market softens.

The spread isn't just about raw returns: it's about risk mitigation. When you're paying $28,000 per acre instead of $100,000, you've got breathing room if your absorption timeline extends or if builder sentiment cools. You're not hanging on by your fingernails hoping the market holds.

Local Knowledge = Competitive Edge

Here's where local expertise becomes critical. Not all 100-acre tracts are created equal, and knowing the difference between a "good deal" and a "great deal" often comes down to hyper-local knowledge: Which school districts are driving buyer preference? Where are the utility districts planning expansions? What's the real story on road improvements?

At Cooper Land Company, we've been tracking these markets for years, watching the migration patterns, the builder activity, and the infrastructure investments. We know which parcels are positioned to benefit from the next wave of growth and which ones are going to sit because they're just a little too far out or a little too complicated on the entitlement side.

That's not something you pick up from a spreadsheet. It comes from being on the ground, knowing the county commissioners, understanding the political landscape around zoning and platting, and having relationships with the builders who are actually cutting checks.

The Forward View

So where does this go from here?

Short-term, we expect to see continued developer migration into Parker and Wise as Collin and Denton pricing remains elevated. The builders are already there: they're actively shopping for entitled lots and development-ready land. The question is how fast the infrastructure can catch up to support the next 5,000-10,000 homes these counties are likely to absorb over the next decade.

Medium-term, we wouldn't be surprised to see Parker County start commanding pricing closer to southern Denton County as the market matures and the "secondary" label fades. Wise will likely remain the value alternative, but even there, the land closest to Denton County is going to appreciate meaningfully.

Long-term? This is the DFW growth story playing out exactly as it has for 40 years: development pushes outward, infrastructure follows, and the "next county over" becomes the primary market. Parker and Wise are simply the current iteration of that cycle.

Final Thought

If you're a developer sitting on capital and trying to figure out where to deploy it, Wise and Parker Counties offer something rare in today's North Texas market: actual margin. The land basis is reasonable, the demand is real, and the infrastructure is either in place or coming fast.

The "secondary market" label won't last long. The smart money is already figuring that out.

Want to explore opportunities in Wise or Parker Counties? Reach out to Cooper Land Company: we know these markets inside and out, and we can help you find the tracts that actually pencil.

OUR LISTINGS